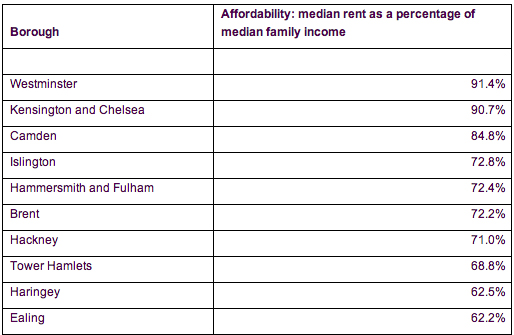

Median rents in Hackney are 71 per cent of the median family income in London. In Tower Hamlets the median rent comes to 68.8 per cent of average income.

Research by the campaign group, Homes for London, set up by housing charity Shelter, has revealed that Hackney has the seventh highest rent:income ratio in London with Tower Hamlets, with 68.8 per cent the eighth. Lewisham and Croydon are a little better but Lewisham rents are still set at just over half the average wage with those of Croydon at 46.6 per cent.

Homes for London is urging action from London Mayor Boris Johnson’s London Rental Standard initiative, which is in deliberation until February 15. Campaign members have voiced concerns regarding climbing rental costs, the instability of rental contracts and the activities of “rogue” landlords.

Analysts say affordable housing in east London continues to be sparse in spite of the recession, a trend likely to continue well into the future.

According to affordable housing advocacy group, the National Housing Federation, average rents are due to rise 50 per cent by 2022, exceeding £2,000 a month, which would likely surpass any pay rises.

Some say one of the major reasons for these high rent rates is the purchase of tax-free UK properties by international buyers. An investigation by The Guardian last year suggested that more than £7bn of offshore money has flooded into potentially tax-exempt purchases of UK houses, flats and office blocks.

Faisal Islam, Channel 4 News’ Economics Editor, said: “London is basically an entirely different property market to the rest of the country.

“You are seeing a huge influx of hot money from troubled countries in the Mediterranean. People are buying up property as a safe investment in London.

He added that specifically in East London, “there is probably a bit of an Olympic impact in Hackney.”

Ian Fraser, managing director of letting company, HomeLet, said: “It is now 86.4 per cent more expensive to rent a home in Greater London than the rest of the UK.”

Despite recognising that London “rents have risen faster than inflation” while incomes continue to remain stagnant, the Mayor’s Housing Covenant states: “Rent controls are not the answer to these affordability issues. Rent controls, particularly if they were applied to existing properties, would limit investment even further.”

*Table provided by Shelter.