Keeping payday lenders off higher education campuses is an aim of the National Union of Students Photo: © Howard Lake

The president of Goldsmiths University Students’ Union has promised to use his powers to keep payday loan companies such as Wonga off campus.

Following a campaign launched by the National Union of Students to help student unions get payday loan advertising banned from colleges and universities, the president of Goldsmiths University Students’ Union, Conrad Grant, has said he will push a motion through the Student Assembly that will prevent the companies, which often charge exorbitant rates of interest, from targeting students at the campus in southeast London.

Grant said: “The Students Unions [have] a responsibility to protect students in all aspects of their lives and the SU officers believe that allowing such companies to exploit students is unacceptable.

“The last thing students need is being targeted by businesses that seek to put profit over actually trying to assist students out of financial hardship.”

A Goldsmiths College spokesperson admitted that there was no policy in place to keep student loan companies away from its campus: “We do not have a policy on payday lenders advertising on campus as we do not invite commercial enterprises, apart from careers day, onto the campus at Goldsmiths. This would be for the Students’ Union to address.”

In the lead-up to a Government-led summit on 1 July that included lenders, Minister for Employment Relations and Consumer Affairs Jo Swinson said: “I have long had specific concerns about the advertising of payday loans and my department has commissioned research to look into the effect of payday lending advertising on consumer behaviour.”

Russell Hamblin-Boone, chief executive of the Consumer Finance Association, which represents the major short-term lenders operating in the UK, said: “There are some things we can look at incorporating into our Code of Practice ahead of formal regulation under the Financial Conduct Authority, such as additional measures on advertising and marketing.”

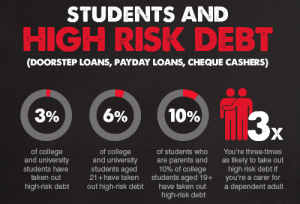

Research published by the National Union of Students (NUS) shows that 10 per cent of students in vulnerable groups had accessed high-risk debt such as payday loans, cash-a-cheque and doorstep loans.

One leading payday lender, Wonga, is currently advertising a loan interest rate of 5,853% APR.

The current Bank of England base interest rate is 0.5%.

The NUS campaign follows recent criticism of payday lenders by the Office of Fair Trading.