Local authorities have been on the frontline throughout the pandemic, providing support to residents and distributing various government grants. But they have also been heavily financially impacted, and councils say years of austerity has made them unprepared for the impact of the pandemic. This could lead to drastic service cuts in the future, as local councils try to stay afloat while providing valuable services to residents.

Councils in more deprived areas such as Tower Hamlets have particularly suffered. Mayor John Biggs has previously said: “The financial support received so far, falls well short of what we have already had to spend to keep our community safe.” He has called for more government support.

Tax Cuts Leave Councils in the Lurch

A main source of income for local authorities lies in business rates that the council would usually collect from businesses across the borough. The income is placed in a Collection Fund, and councils are paid fixed amounts from this based on the forecast business rates income at the start of the financial year.

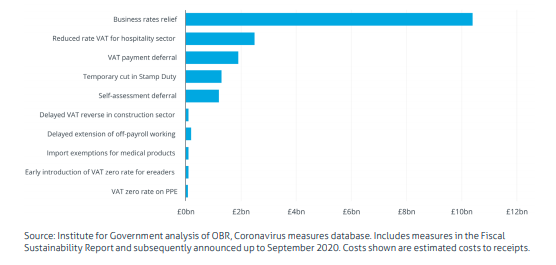

In the March 2020 Budget, Chancellor Rishi Sunak announced that retail, leisure and hospitality businesses with a rateable value of less than £51,000 would be eligible to have their business rates scrapped for the 2020/21 financial year so that they would be able to deal with the impact of Covid. This was then extended to all businesses in those sectors regardless of their value – making it the biggest single tax policy measure announced in the government’s response to Covid.

A year on, in the 2021 budget it was announced that such businesses will continue to pay no business rates for up to three months, and then rates will be discounted by two thirds for the rest of the year – in a £6bn tax cut. This could be good for individual businesses – but where does this leave local authorities?

A Gap in Funding

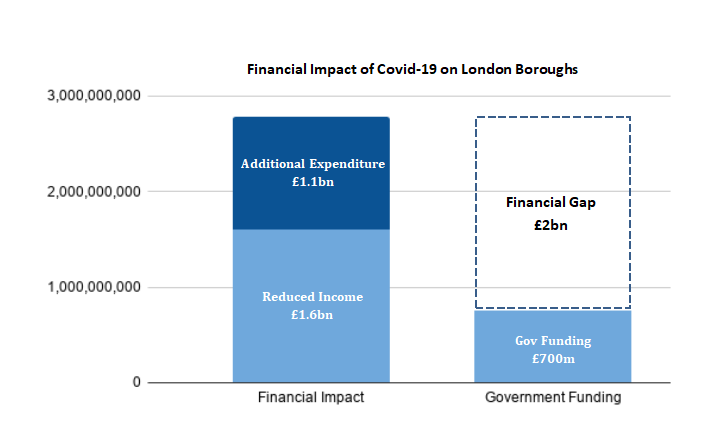

The government has provided emergency funding of £750m so far across the London boroughs to help compensate for this loss of income. However, there is still a gap in funding of around £2bn, demonstrating how much local authorities will be affected. Business rates relief makes up a large proportion of the reduced income shown on the graph.

London Councils, a cross-party organisation that represents all of London’s 32 borough councils has called for more government support. In response to this funding gap, the chair Georgia Gould said: “London boroughs are at the heart of their communities and have played a pivotal role in responding to Covid-19 – protecting the most vulnerable, delivering new services, and working closely with Government to communicate advice and information to our residents.

“We need financial certainty and stability to continue delivering effective services, to keep people safe, and to help businesses through the unpredictable months ahead” she added.

Tower Hamlets has historically been one of the most deprived boroughs in the whole of London, with the highest rates of child poverty in England at 32.5% and the highest number of people living in poverty out of all London boroughs at 39%. The council has faced increased financial pressures over the years and cites a decade of austerity as a key reason. Funding for youth services has fallen by 72% between 2010/11 and 2018/19, and the adult social care sector has seen closures of day centres as a result of cuts.

As a result of Covid-19, the council faces even more financial challenges. This can be seen in Tower Hamlets’ recent budget consultation, where they said that due to austerity, changes to council funding and Covid-19, they would have to save an extra £30 million by 2024 – working out at £90 per resident. This has been factored into their 2021/22 budget, with an increase in Council Tax and rent.

Data gathered by the Institute for Fiscal Studies shows that Tower Hamlets has suffered the most in terms of income lost through business rates in comparison to Croydon, Hackney, and Lewisham. Tower Hamlets would usually receive £143.8m in business rates revenue, making up the largest proportion of their budget.

Councillor Candida Ronald, Tower Hamlets Cabinet Member for Resources said: “The funding shortfall due to COVID-19 shows yet again that local councils are an afterthought for the government. Our budget was already under pressure from increasing demand on local services at the same time as annual funding cuts.

“COVID-19 has highlighted the importance of well-funded local services for our residents. Our community needs this money back to recover from the lockdown and to enable us to support them through the resulting economic fallout.’’

The expanded retail discount had already cost Tower Hamlets just over £100m back in March 2020. As of October 2020, the council was compensated for around £94m through the S31 government grant, however a gap of approximately £7m remained. In their budget consultation, the council stated that due to these pressures, they will not be able to keep all their services open, and that “the money [they] have spent so far on Covid-19 and the loss of income has not been fully covered by the Government.”

Mayor of Tower Hamlets John Biggs has previously pleaded for more funding, and said: “After a decade of austerity, we are now seeing the scarring impact of these cuts. The Covid-19 pandemic has exacerbated the already-perilous state of local government finances and it’s time for the government to end austerity and invest in public services.”

In their budget consultation in late 2020, the council hit back at the government for this gap in funding, stating that: “The government has not kept up to its promise ‘to do whatever it takes’ by covering all our spending and lost income arising from Covid-19. This makes our budget even more difficult to balance this year.”

In response to the government’s spending review in September 2020, Biggs said: “The pandemic has taught us that investment in public services has clear long-term benefits. Local authorities’ key role in dealing with both the public health and economic effects of the pandemic has shown that councils have the knowledge and expertise to make effective decisions about their local areas. I think it’s time to put local government at the centre of your pledge to end austerity.”

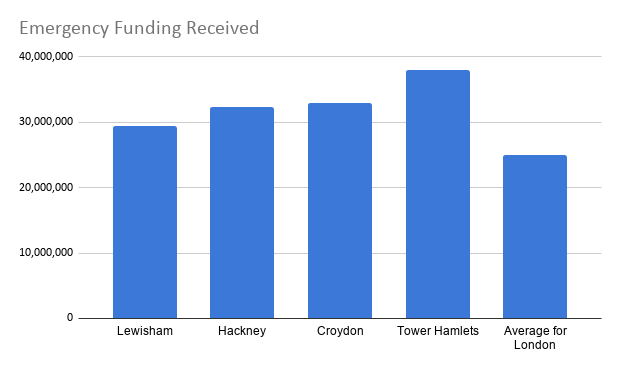

Tower Hamlets has received the largest amount of emergency funding out of the ELL boroughs, but there is still a gap that must be compensated for in the future.

Their latest budget is largely a reflection of their lack of funding from the government both in response to Covid-19 and a decade of austerity. The budget states that: “Since 2011-12 in the face of unprecedented reductions in Government funding and increasing demand on services, the need to make savings has dominated the Council’s financial planning process.”

Tomorrow: Meet three of Rishi’s forgotten three million